Cineplex

What it is

The largest movie theatre chain in Canada.

The problem it solves

Cineplex provides people with a big-screen entertainment experience they can't get at home.

Let's go deeper ↓

Zoom in

Here are some notable stats and news you should know:

Vitals

- Founded in 1979 and went public in 2003

- Market cap of ~$680M

- As of Q2 2025: 155 theatres, 1,607 screens

- 2024 theatre attendance: 43M

- 73% market share in Canada

- Competition: Landmark Cinemas, Imagine Cinemas, Cinémas Guzzo, and others

Did you know?

- Has 15M members in its Scene+ loyalty program, which it co-owns with Scotiabank and Empire

- December 2019: was set to be acquired by Cineworld (2nd-largest cinema chain in the world) but the deal fell through

- Would have valued Cineplex at $2.8B (over 4x the current valuation)

My take

Aren't movies amazing? Especially in a theatre?

For a couple of hours you can be immersed in an entirely different world on a big screen. Add in a bag of delicious popcorn and it's an A+ experience.

However, as great as movies are in a theatre, the cinema business is threatened by streaming. After all, it's nice to watch a movie on your couch, pause whenever you want, and turn on the subtitles (guilty).

As you'd expect, Cineplex hasn't escaped the rise of Netflix and the dozens of other streamers. To illustrate, here is its theatre attendance at its peak in 2015, pre-Covid in 2019, and last year1:

- 2015: 77M

- 2019: 66M

- 2024: 43M

It's trending downwards at a fairly fast pace (contracting on average by roughly -6% per year). But it's not all doom and gloom. That's because Cineplex is more than just a movie business.

Over the years, Cineplex has expanded from being a pure-play cinema company into a diversified entertainment, food, and media company.

In this analysis, I'll be focusing on what I find most compelling: the food and movie portions of the business. But before we dive in, let's get acquainted with all of Cineplex's businesses at a high level.

How it makes money

As mentioned, Cineplex is more than a movie business.

Cineplex makes money in five ways (in order of revenue):

- Box Office - selling movie tickets

- Food Service - selling popcorn, beverages, other food, etc.

- Media - commercials and ads in and around the theatre, digital signage in retail and malls, etc.

- Location-based Entertainment - amusement and gaming rooms (The Rec Room, Playdium)

- Other - gift card sales, private parties, etc.

Now for a closer look at the two biggest businesses.

Film and food

It's common knowledge that movie theatres make a lot of money on food.

Think of how much popcorn is constantly being popped, bagged and sold in every theatre. Or how many drinks, bags of candy or chicken nuggets are sold.

I think we all have a sense that food brings in a lot of money, but what are the actual numbers, and how does it compare to what the movie business brings in?

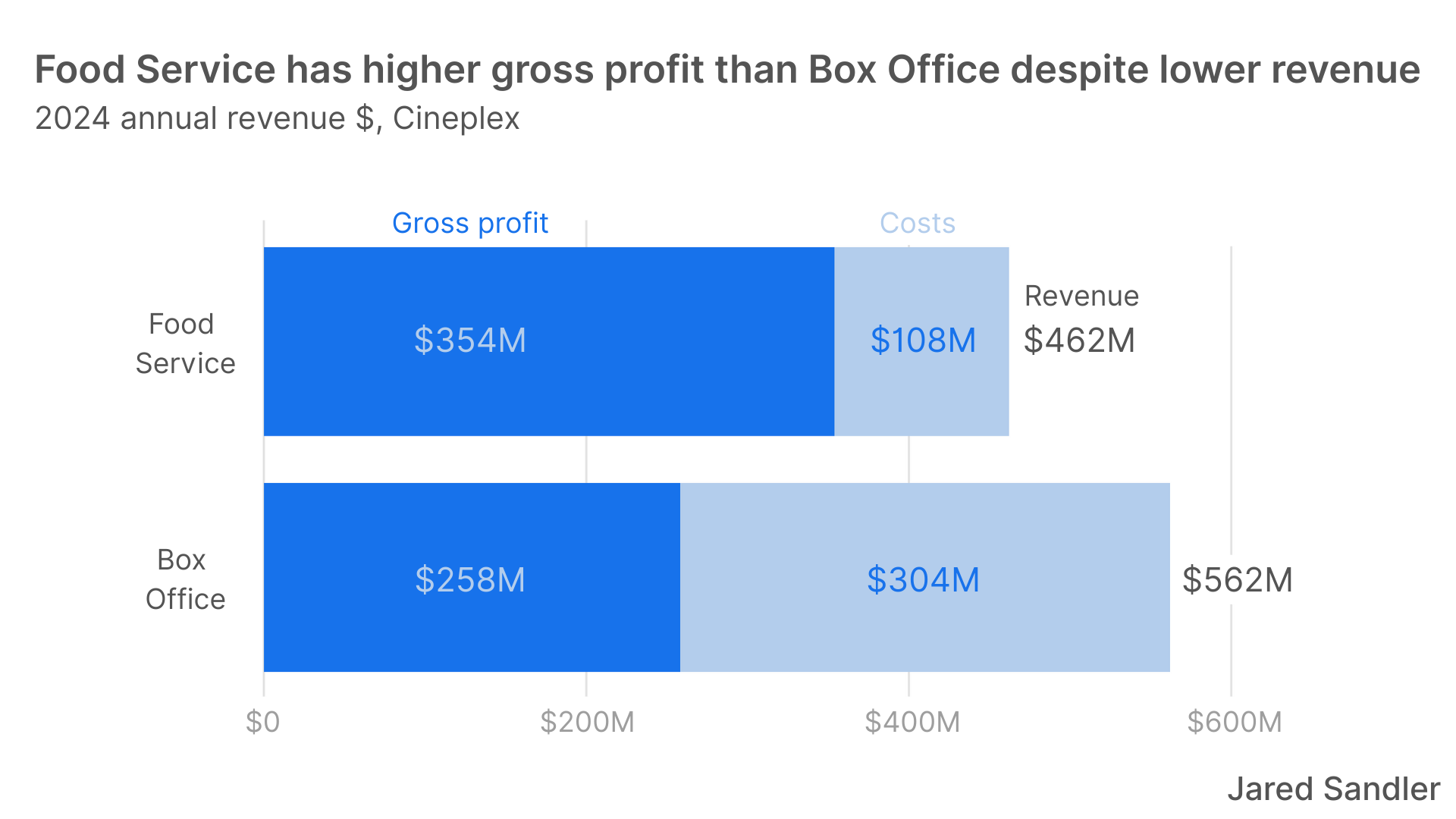

To answer those questions, here's Cineplex's revenue from its Food Service and Box Office businesses for 2024:

- 🍿 Food service: $462M

- 🎟 Box office: $562M

You might be surprised to see that Food Service brings in nearly as much as the Box Office (yes $100M is a big difference, but it's a lot less than one might expect).

To see this better, I've visualized it in the graph below along with costs and gross profit.

Each bar is for revenue and is made up of the darker blue portion for gross profit and the light blue portion for costs.

Gross Profit + Costs = Revenue

A few things stand out from this graph. Starting with revenue:

Revenue

🎟 > 🍿: Box Office revenue exceeds Food Service revenue.

But not by that much: $562M vs $462M (about a 22% difference).

This means:

- Cineplex's secondary business, food, is almost as important revenue-wise as the business the company is best known for, movies.

- It's better to view Cineplex not as an entertainment business but instead as an entertainment and food business.

As for gross profit:

Gross Profit

🎟 < 🍿: Box Office gross profit is less than Food Service gross profit.

$258M vs $354M.

This means:

- Cineplex nets more money from food than movies despite having lower revenue.

- The food business has extremely high margins.

And those high margins on food mean something else:

Food is the better business

Movies get people in the door, but it’s the food that feeds the bottom line.

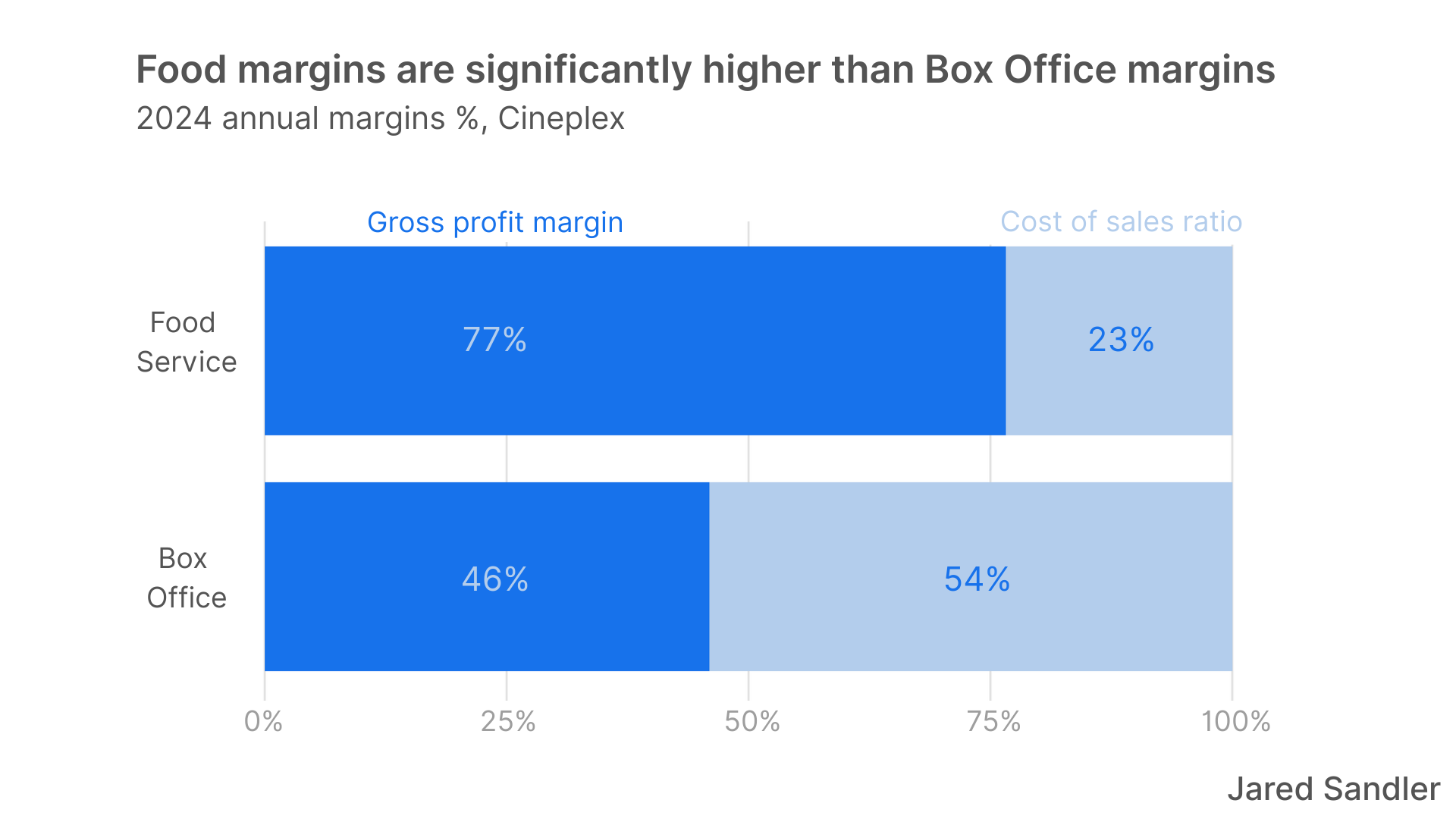

Here's another way to look at the margins to see how profitable Food Service is compared to the Box Office:

For Food Service, gross profit margins are about 77%, or visually, the darker blue portion makes up over three-quarters of the total bar.

On the other hand, the gross profit margins on the Box Office don't even crack halfway, at 46%.

Put another way (before other indirect costs):

- A $10 movie ticket → Cineplex nets $4.60

- $10 in food → Cineplex nets $7.70

Food is the profitability engine. So it’s no wonder the company expanded its amusement business by introducing The Rec Room in 2016. It’s a place for games, events, and socializing, but more importantly, it’s another way to sell more highly profitable food. This begs the question:

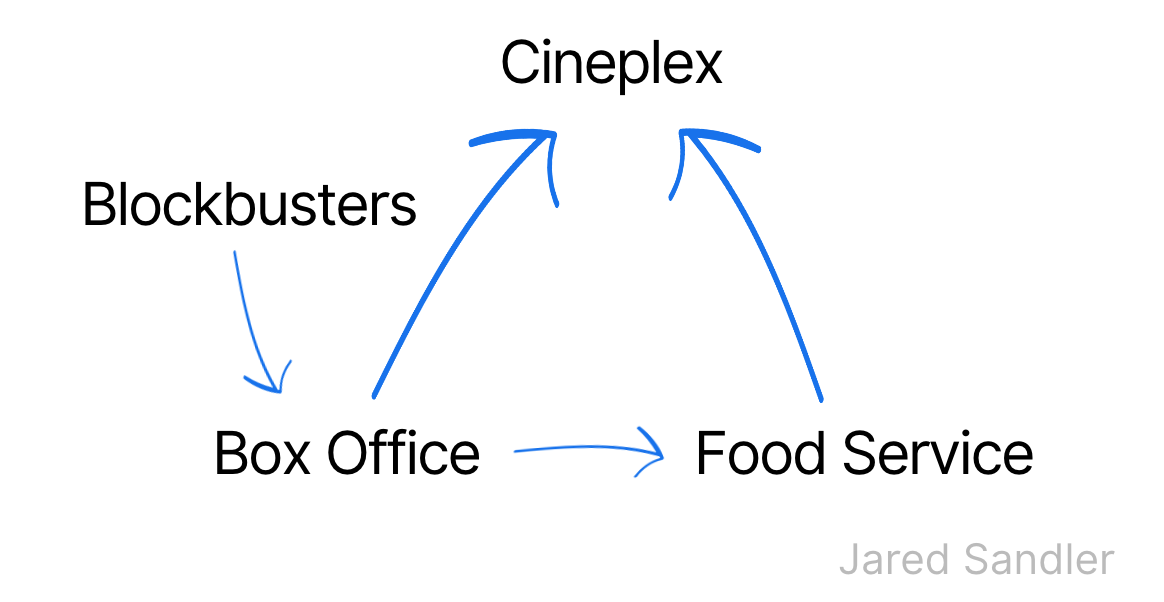

Why not focus only on food?

Forget about the lower margin, downward trending movie business and go 100% in on the high margin food business - why not do that?

Cineplex can't do that because the food doesn't get people in the door. Ever heard of someone going to a movie theatre for dinner and not a movie?

And that's the crux of it.

Cineplex can't go all-in on being a food business because people don't go just for the food.

And it can't go all-in on being a movie business because:

(a) the margins aren't as good, and

(b) it's a contracting business

Each part of the business needs the other:

Hollywood makes blockbusters

↓

Cineplex screens blockbusters

↓

Blockbusters attract large audiences to the theatre

↓

Audiences in the theatre buy snacks

↓

Snacks are highly profitable

You can see how important the first two steps in that chain are and how they kick off the process.

It's all about the blockbusters

It should be no surprise that the business relies heavily on hits. Big movies are events, even phenomenons. Examples: the Avengers movies of the last decade or 'Barbenheimer' two years ago.

Looking at the most important movies for Cineplex the last few years, it's clear that a few blockbusters make up a significant portion of revenue.

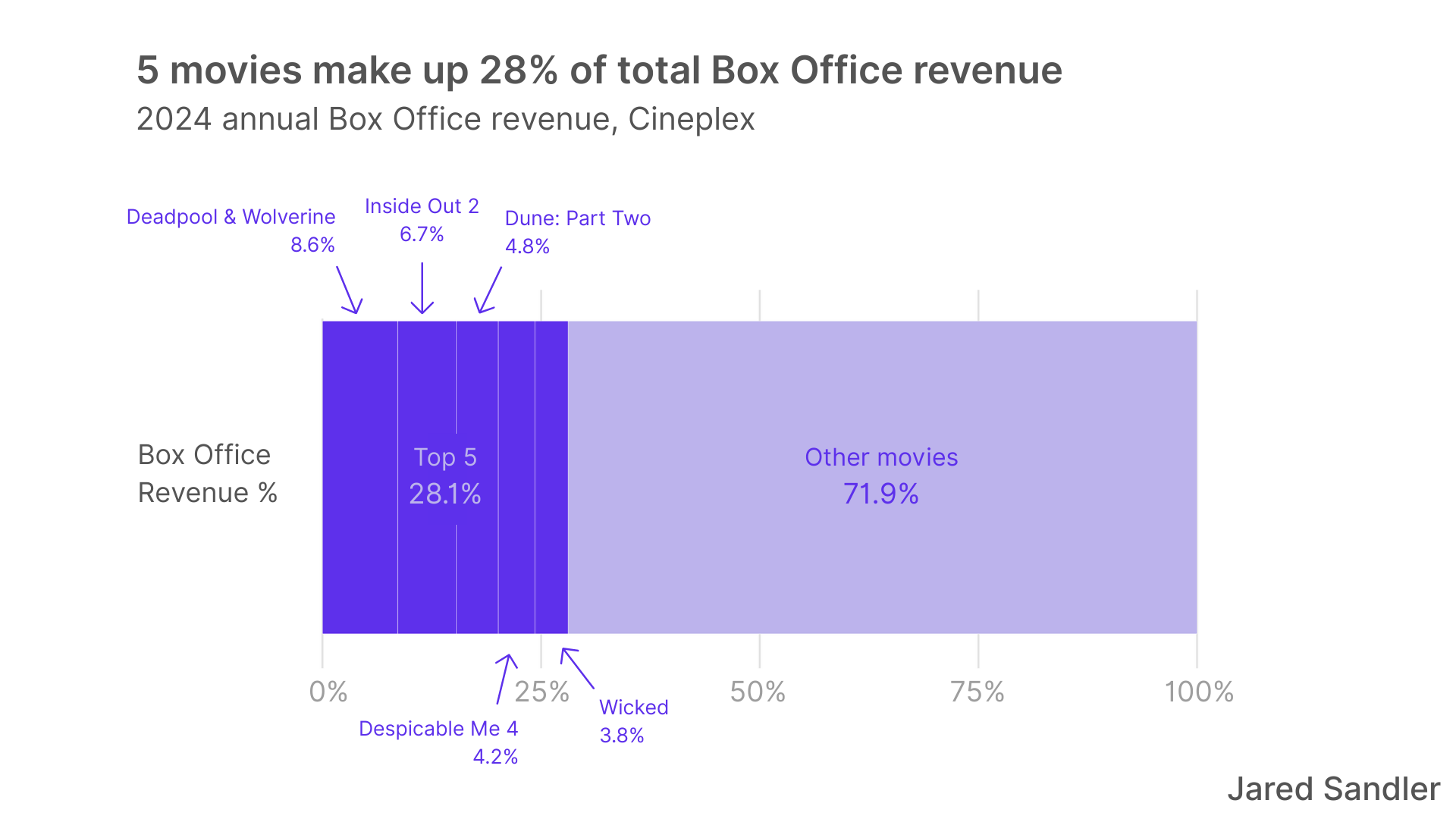

Take the top five movies of 2024. Here's how much each movie contributed to Box Office revenue:

- Deadpool & Wolverine: 8.6%

- Inside Out 2: 6.7%

- Dune: Part Two: 4.8%

- Despicable Me 4: 4.2%

- Wicked: 3.8%

Just five movies accounted for over a quarter (28.1%) of movie revenues for the entire year. Here it is visualized:

The blockbuster-heavy nature is even more pronounced when looking quarterly rather than annually. One recent quarter in particular, Q4 2022, clearly illustrates the importance of blockbusters.

In that quarter, just two movies accounted for 45% of Box Office revenue2:

- Avatar: The Way of Water: 25.2%

- Black Panther: Wakanda Forever: 19.9%

How many other companies get almost half of their quarterly revenue from such few products?

And this brings up another downside of the theatre business: Cineplex is stuck with whatever films the studios and distributors release.

Few movies are out?

Nothing good is out?

Nothing popular is out?

Cineplex suffers.

While there are many downsides to this business, there are bright spots too.

The upsides

In addition to the high margin food business, Cineplex has this going for it:

- Repeat customers

- A high market share

- Potential competitors face high-barriers to entry (cinemas are expensive and take time to build, among other barriers)

- Strong loyalty program

- Diversified revenue streams

- Diversified geographically across the country

And one more.

Bonus revenue stream

There's another line on its income statement that stands out. It's about food delivery.

If you didn't know this, you can see for yourself. Open up a food delivery app like Uber Eats or DoorDash, search for Cineplex, and you'll see that you can order movie theatre popcorn, chicken sandwiches, nachos, and more.

This is great for customers who want theatre food but don't want to leave their home. This is also great for the company because it's another way for it to make money outside of its traditional concession sales.

Another amazing thing - food delivery allows Cineplex to tap into a larger customer base than it could have before.

The potential buyers of its food went from being limited to those who were physically at its properties to being anyone in a drivable distance. And this likely happened with very minimal changes to its concessions (probably only adding special bags for holding the food and tweaking systems to accept online orders).

The timing was great, too.

Cineplex made popcorn and concessions available for delivery in 2018, which was around the same time the movie business began trending downwards. Last year, Cineplex made $7.8M from people ordering food delivery3.

In a way, the extra revenue from food delivery is bonus money. But $7.8M isn't enough to move the needle for the company. Here's the great thing about it, though: it's food. That means high margins.

Bottom line

Cineplex's business is more layered than it first appears. It’s a reminder that a company’s headline business rarely tells the full story.

In Cineplex's case, it's as much about selling snacks as screening films.

And it's a company that isn't done changing - with its push for diversification and the pressures of streaming, Cineplex will most likely adapt again.

So grab your popcorn, settle in, and watch what happens next. The show isn't over.

Endnotes

1 Page 10 of 2019 annual report

2 Page 28 of 2022 annual report

3 Page 28 of 2024 annual report

👋 Hey, thank you for reading!

If you'd like to get in touch, please reach out on LinkedIn.

Read more

If you liked reading about the movie business and want to learn about another fascinating business, check out this post on the airline business and the story of Porter Airlines.

💡 Want company analyses directly to your inbox? Subscribe