Questrade

In any case, this is a must-know company if you're interested in the Canadian investing space.

In this 4-minute read, I go over the DIY investing landscape and the major part Questrade has played in it. Enjoy.

What it is

A Canadian brokerage and wealth management firm offering low-cost investing products.

Let's go deeper ↓

The problem it solves

Problem:

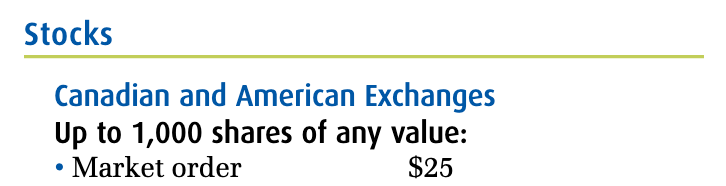

$25 to buy a share?

The commission fee might be more than the share price.

Solution:

Questrade makes it less expensive to invest and trade.

Zoom in

Here are some notable stats and news you should know:

Vitals:

- Private company

- Founded in 1999

- $50 billion in assets under administration (AUA)

- To put it in perspective: that's roughly the same as Dollarama's market cap

- In comparison: less than Wealthsimple's $84B

- Offices in Canada, Armenia, Barbados, Brazil, Israel, Ukraine

- Competition: Interactive Brokers, Wealthsimple, Qtrade, Robinhood, BMO InvestorLine, TD Easy Trade, and many many more

Do you remember?

- Had a popular ad campaign asking, "you're not still investing with mom and dad's guy, are you?"

Trending down:

- End of 2024: Laid off an undisclosed amount of employees

- Closed their mortgage offering, QuestMortgage, after a short-lived 30 months

Trending up:

- Major marketing campaign with Harvey (Gabriel Macht) from the show, Suits

- February 2025: Introduced $0 commission trades

My take

If you wanted to trade a stock by yourself 20+ years ago, you were looking at paying through the nose. Something like a $25 commission fee.

To see what I mean, let's look at a BMO brochure from May 1, 2006.

Here's a screenshot from it that shows what they used to charge to trade electronically:

$25! Trading was expensive.

Good thing those days are gone.

Fast forward 20 years, and those $25 commission fees on stocks are down to:

- $9.99 (in the case of Scotiabank and TD)

- $9.95 (BMO and RBC)

- $6.95 (CIBC)

- $0 (Questrade, Wealthsimple, National Bank, and again TD)

$0. Zilch. Nada. Nice.

What's amazing is that it's like we're in a different universe now compared to 20 years ago. A universe where it can cost you nothing to trade.

To illustrate how important this change is, let's quickly run through what trading might have cost you back then.

What it cost

Say you make just 4 trades per month (you get paid twice a month and make two transactions every paycheque).

That's very low volume but it's absolutely plausible. You might be a passive investor regularly buying shares in a couple companies and not actively trading in and out of positions.

At $25 a pop, those 4 trades used to cost you $100 per month. Or $1,200 per year.

That's not an insignificant amount of money.

And think of if you didn't pay those fees every year.

For five years, that's $6,000 that stays in your pocket.

For ten years, that's $12,000.

And if that money was being invested, earning 5% a year? In 20 years, that money... well, you get the idea. It's a lot of money.

Money that used to be deleted from your portfolio now gets to stay and grow.

And Questrade played a part in that change.

To be clear, Questrade wasn't the first to offer $0 trading commissions, but they were among the first in Canada to offer cheaper trading.

And they've been doing it for decades. Want proof?

Rewind

Here's something cool - the homepage of Questrade's website back in August 2002 (via the Wayback Machine):

Aside from having a different colour scheme (no black and green) and the early 2000s internet style, what stands out the most is the WordArt-esque text promoting $9.95 commissions per trade.

Remember, this was 2002.

- Michael Jordan was still playing in the NBA

- Season 4 of Survivor had been released just a few months earlier (they're now on season 49)

- Friends was still on the air

- The Xbox 360 was a few years away from its release

2002 feels like ages ago, and even then they were offering $9.95 per trade.

What they were charging 20 years ago is what some brokerages still charge today.

If you need any proof that Questrade is a pioneer in low-cost trading and investing in Canada, that screenshot is it.

And that's been good for all of us. Like saving-$1,200-a-year good.

Bottom line

This is a company that offered people cheaper trading, and has been doing it for ages.

👋 Hey, thank you for reading!

If you'd like to get in touch, please reach out on LinkedIn.

Read more

If you liked this post, then I think you'll like this one about another low-cost trading platform: Wealthsimple

💡 Want company analyses directly to your inbox? Subscribe